How a Small Bakery Flourished: The Power of Building Business Credit with Spartan Café

|

Getting your Trinity Audio player ready...

|

Empowering Entrepreneurs to Transform Dreams into Reality with Solid Business Credit Foundations.

When Sarah first started her small bakery in a quaint corner of her hometown, she poured her heart and soul into every detail. From handpicking the freshest ingredients to designing the cozy interior where customers could enjoy her confections, Sarah was committed to making her business a success.

Yet, despite her passion and hard work, she quickly encountered a challenge that many new business owners face—securing the funding needed to expand and grow.

Sarah's bakery was thriving, with a steady stream of loyal customers and glowing reviews. However, when she sought a loan to upgrade her kitchen equipment and hire additional staff, she faced rejection after rejection. The banks cited her lack of established business credit as a major hurdle, leaving her feeling frustrated and stuck.

One day, while scrolling through social media, Sarah stumbled upon Spartan Café, a vibrant online community for entrepreneurs. Intrigued by their tagline, "Main Street's Gateway to Wall Street," she decided to explore further.

She discovered that Spartan Café offered a comprehensive Business Credit Builder course designed to help small business owners like her establish and improve their business credit.

With renewed hope, Sarah signed up for the course. Guided by the step-by-step instructions, she learned how to separate her business and personal credit, register with business credit bureaus, and build credit lines with vendors. The support from Spartan Café’s community and experts was invaluable, providing her with the knowledge and confidence she needed to navigate the complex world of business finance.

Six months later, Sarah's bakery was not only a local favorite but also a creditworthy business with access to significant credit lines. She secured the funding to expand her operations, purchase new equipment, and hire additional staff. Her story is a testament to the power of strong business credit and the transformative impact of Spartan Café.

Today, Sarah’s bakery continues to flourish, serving delicious treats to the community while she dreams up new ways to grow her business. Her journey, from struggling with funding to becoming a thriving entrepreneur, underscores the importance of building robust business credit. Thanks to Spartan Café, Sarah unlocked the gateway to a brighter, more prosperous future for her business.

Key Takeaways:

Spartan Café's Business Credit Builder course provides a comprehensive guide to establishing strong business credit.

Strong business credit is essential for securing larger funding amounts without personal liability.

The course helps separate business credit from personal credit, safeguarding personal assets.

Users can access significant credit lines, ranging from $5,000 to $50,000.

Spartan Café offers ongoing support and resources for continuous business growth.

The Importance of Business Credit

Building strong business credit is a pivotal step for any entrepreneur or small business owner aiming to secure funding and achieve sustainable growth. Unlike personal credit, business credit reflects the financial health of your business, influencing your ability to obtain loans, secure favorable terms, and maintain operational cash flow.

Spartan Café's Business Credit Builder course is designed to guide you through this critical process, providing the tools and knowledge needed to establish a robust credit profile.

1. Understanding Business Credit

Description: Before diving into the specifics of building business credit, it's important to understand what it is and why it matters. Business credit is a measure of a company's ability to repay debts and is used by lenders, suppliers, and other creditors to assess creditworthiness.

Definition: Business credit refers to a company's financial reputation and creditworthiness.

Importance: Good business credit can lead to better loan terms, lower interest rates, and increased borrowing power.

Separation from Personal Credit: Distinguishing between business and personal credit protects personal assets and liabilities.

2. The Spartan Café Business Credit Builder Course

Spartan Café's Business Credit Builder course offers a structured, step-by-step approach to establishing and improving business credit. This course is tailored to meet the needs of entrepreneurs and small business owners, providing comprehensive guidance and support.

Step-by-Step Guide: Detailed instructions on how to build and maintain business credit.

Access to Credit Lines: Learn how to secure revolving credit lines ranging from $5,000 to $50,000.

Educational Resources: Access to a wealth of knowledge on financial management and credit building.

Support System: Ongoing support from Spartan Café's financial experts.

3. Steps to Building Business Credit

Building business credit involves several key steps, from establishing your business entity to maintaining good credit practices. Spartan Café's course covers each of these steps in detail, ensuring you have a solid foundation.

Establish a Business Entity: Form a legal business entity, such as an LLC or corporation.

Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS.

Open a Business Bank Account: Separate personal and business finances by opening a business bank account.

Register with Business Credit Bureaus: Ensure your business is registered with major credit bureaus like Dun & Bradstreet.

Build Credit with Vendors: Establish credit lines with suppliers and vendors that report to credit bureaus.

Exclusive, Actionable, and Intelligent News Trusted by Serious Entrepreneurs, Creatives, and Finance Enthusiasts

4. Benefits of Strong Business Credit

Having strong business credit can unlock numerous benefits for your business, from improved financing options to enhanced credibility with suppliers and partners.

Increased Funding Opportunities: Access larger loans and lines of credit with better terms.

Lower Interest Rates: Benefit from lower interest rates on loans and credit lines.

Improved Supplier Relationships: Gain credibility with suppliers and negotiate better payment terms.

Reduced Personal Liability: Protect personal assets by separating business and personal credit.

Business Growth: Use credit to invest in growth opportunities and expand operations.

5. Overcoming Common Credit Building Challenges

Building business credit can be challenging, especially for new businesses. Spartan Café 's course addresses common obstacles and provides strategies to overcome them.

Limited Credit History: Strategies to build credit from scratch.

Financial Management: Tips for maintaining good financial practices and avoiding debt.

Navigating Credit Bureaus: Understanding how to work with business credit bureaus.

Dealing with Rejections: How to handle credit application rejections and improve your chances.

6. Maintaining Good Business Credit

Once you've established business credit, it's crucial to maintain it. Spartan Café offers ongoing support and resources to help you keep your credit in good standing.

Timely Payments: Always pay bills and credit obligations on time.

Credit Utilization: Keep credit utilization low to maintain a good credit score.

Monitor Credit Reports: Regularly check your business credit reports for accuracy.

Financial Planning: Plan for future financial needs and avoid over-leveraging your business.

Ongoing Education: Continue learning about business finance and credit management.

7. Spartan Café's Additional Resources

Description: Beyond the Business Credit Builder course, Spartan Café offers a range of resources to support your business growth and financial health.

Networking Opportunities: Connect with other entrepreneurs and potential investors.

Educational Courses: Access a variety of courses on business funding, financial management, and more.

Crowdfunding Support: Learn how to launch successful crowdfunding campaigns.

Real Estate Financing: Explore options for real estate investments and financing.

Financial Planning Tools: Utilize tools for budgeting, forecasting, and financial analysis.

Expert Consultations: Get personalized advice from financial experts.

Community Engagement: Participate in forums, webinars, and events to stay connected and informed.

Recap and Conclusion

Building strong business credit is essential for any entrepreneur or small business owner looking to secure funding and achieve long-term success.

Spartan Café's Business Credit Builder course offers a comprehensive, step-by-step guide to help you establish and maintain robust business credit. By following the course's guidance and utilizing the platform's extensive resources, you can unlock significant credit lines, protect your personal assets, and position your business for sustained growth.

Spartan Café goes beyond credit building, offering a holistic approach to business finance with networking opportunities, educational courses, and ongoing support.

Whether you're just starting out or looking to expand, Spartan Café provides the tools and community you need to succeed.

Online Resources

Small Business Administration: SBA Official Site

Dun & Bradstreet: D&B Business Credit

Investopedia: Financial Education Resources

NerdWallet: Business Credit Card Reviews

Credit Karma: Monitor Business Credit

Entrepreneur Magazine: Business Finance Articles

Building business credit is not just a beneficial step; it is a necessary one for the financial health and growth of your business.

With Spartan Café's guidance, you can navigate the complexities of business credit and unlock opportunities that drive your business forward. Join Spartan Café today and take the first step towards empowering your business with strong credit foundations.

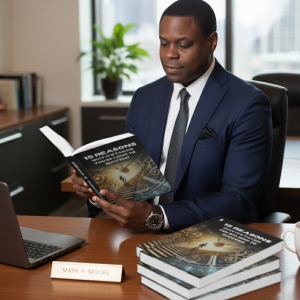

AUDIO BOOK: 15 Reasons Why It’s Taken You So Long to Succeed

AUDIO BOOK: 15 Reasons Why It’s Taken You So Long to Succeed